It's a CONFIRMED scam company, recover your stolen funds by clicking the button below, then fill out the form and you will get a FREE Mychargeback consultation today:

EUFM, better known as European Financial Market (eufm.eu), is on the blacklist of CNMV. The platform has been on the crosshairs of regulators due to harsh investing and trading conditions. According to the homepage, the platform claims to be committed to providing excellent services. Some of their trading niches include Crypto and Forex. The platform further suggests they have been putting clients first since 2015. Learn more about this forex investment platform in our comprehensive EUFM REVIEW.

On their about us page, the platform sells itself as a global crypto and forex investment house. The platform claims to give access to over 40,000 trading instruments. With the leverage set at 1:500, we see why regulators are blacklisting the platform.

The high leverage means users will likely lose a huge chunk of their investment. Most regulators in the EU region have set the maximum leverage at 1:100. Whoever goes against this rule is added to the regulator’s blacklist.

EUFM has done its best to produce a make-believe website. However, with the aesthetic appeal, we get why most novice investors have fallen for this platform. We are here to help open your eyes to the hidden traps set by the platform.

Before we do so, you need to understand Crypto and forex investment is real. You only need to partner with admissible platforms that have been proven to work. Today’s investor goes for Coin staking, DeFi, and Masternoding as ways of making realistic returns.

You, too, can become a successful investor; you only need to avoid falling into traps. With the warning out, it’s hard to believe that such a website is blacklisted. So how does a regulator add such a platform to their blacklist?

Here are some of the reasons that led the European Financial Market to be on the blacklist of CNMV.

Try SMARD today, it is a bot designed for crypto traders and investors which uses advanced algorithms to profit from market fluctuations. No programming or trading knowledge is required to start. The algorithm relies on momentum effect strategies to systematically identify market winners. Below are the key reasons why everyone loves Smard.club: 1. You get up to 5% average monthly return on your starting capital. 2. The 10% monthly service fee is charged from your profits only. They don't make money unless you do! 3. You can start with as little as $1000 in your exchange account, meaning that you just need to connect your existing exchange (or open a new one) with Smard and begin trading right away! 4. No upfront payments for the service. 5. It's a smart way of investing in your favourite crypto coins - btc/altcoins, hurdling them while at the same time growing their values through auto-trading instead of just buy and forget. Operating through API keys, SMARD ensures secure connections without requiring fund transfers to third parties. No upfront payment or card linking is needed. Try Smard today and see the real potential of your crypto portfolio, no upfront fees to pay!

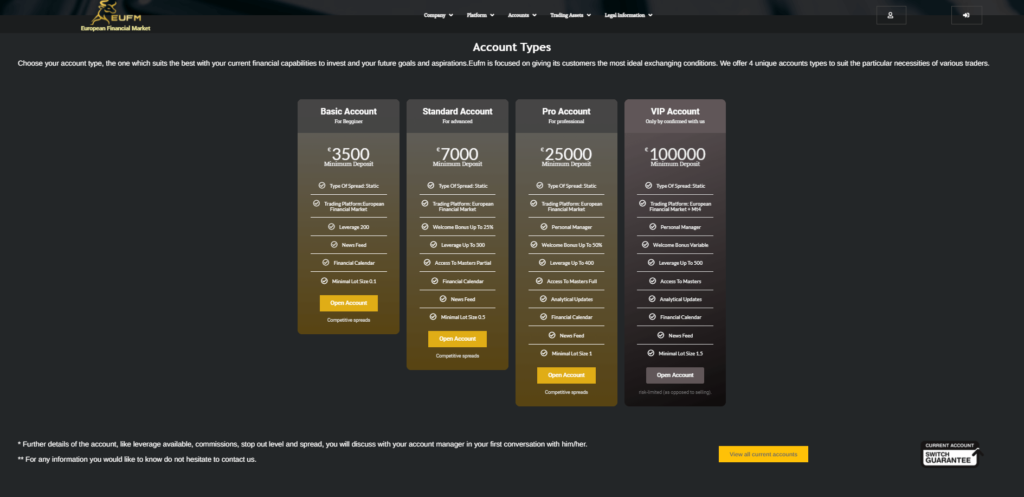

EUFM offers four investment plans to members who have some notable flaws. The first flaw is the high depository requirement for their basic account. Let’s take a look at each account;

Basic Account

The basic account is set for beginners. You have to deposit a minimum of 3500 Euros to start trading. The types of spreads found on all accounts are static. Leverage for this account is also high as they set it at 1:200.

Standard Account

According to the platform, the standard account is for advanced investors and traders. The minimum set deposit for this account is set at 7,000 Euros. There’s also a welcome bonus of 25 percent with members getting access to Masters partial. The minimum lot size is set at 0.5, with the leverage set at 1:300.

Pro Account

It’s for the professional trader and comes with a minimum deposit of 25,000 Euros. You get a personal account manager, and the leverage is set at 1:400. There’s a welcome bonus of 50 percent with members getting analytical updates. The minimum lot size is 1.

VIP Account

To get started with this account, you must first confirm with the staff. The minimum allowed deposit is set at 100,000 Euros, and leverage is set at 1:500. Next, you get an account manager, and surprisingly, there’s no bonus offered with this account.

The allure of having a professional account manager is not one to ignore. EUFM has, however, used this to their advantage. The platform only offers account managers to those who deposit more than 3,000 Euros. We have little to no information on who these account managers are.

You should know the professional status of the person managing your account. In most cases, these people only call members asking for more deposits. You won’t go two weeks before you get a call from the account managers.

These may be call agents who earn their commissions from every deposit made by the member. Once you deposit and send a withdrawal request, the account manager all of a sudden goes silent.

There are four trading assets available on the platform. The four include Commodities. Cryptocurrencies, Forex, and stocks.

Commodities

You get a CFD WTI commodity variation which comes with no commission. Members can either choose to use independent strategies or robot strategies. Some of the commodities include cotton, natural gas, petroleum, and Sugar.

Cryptocurrencies

The platform offers four main crypto assets: Bitcoin, Ethereum, Litecoin, and Zcash. According to the platform, the advantages of trading crypto on their platform include low fees and instant payments.

Forex

For the forex market, the platform only deals with major and minor currency pairs. These include USD/JPY, TRY/JPY, and EURUSD.

Stocks

You can trade stocks on the EXOO4 platform. Some of the features they claim to offer include no commissions, endless liquidity, and over 300 available stocks. Expect to trade stocks from the FAANG group and other global company shares such as Boeing and Visa.

The mind of the novice investor and trader will go for accounts with high bonuses. At the end of the day, the high bonus offers users the chance to get more funds. Regulators, however, have a different view of this and are against platforms that offer welcome bonuses.

You see, with the welcome bonus, members will eventually have to pay back the bonus. So it begs the question of why issue the bonus if you will later pay it back. Most platforms have been using bonuses to leverage members into depositing more funds.

To withdraw any amount, these platforms dictate that you must pay back the bonus amount./ Even if your account has the balance to pay, they demand a new deposit. Of course, they do this to gauge whether you want out. Once you make the mistake of sending the bonus, they won’t process your withdrawal.

EUFM is not a licensed entity and does not have any right to offer investment and trading services. With a warning from CNMV, it’s clear we are dealing with a blacklisted entity. The regulator has been receiving complaints from several quarters.

With the platform offering high leverage and an unimaginable depository amount, they had to act. A blacklisted platform should be the last option for trading. The platform does not pass any regulation and should not handle funds.

When looking for a favorable investment and trading platform, make sure to check the leverage. The acceptable leverage set by the industry is 1:100. Any platform that offers high leverage is putting your investment at risk.,

An excellent example is the Pro account which has a leverage of 1:400. If you perform a Buy or Call order and go against your way, you lose more money.

EUFM also offers Islamic Trading accounts. For example, you can get Halal gold: oil and silver account.

There’s no safety of funds with a platform that CNMV has blacklisted. So the best option is to stay away from it.

We are adding EUFM to our blacklist for the above reasons. So please stay away and use expert-backed options.

What’s the best alternative to EUFM? Go for proven platforms that offer realistic and safe investment practices.

If you want more information, feel free to leave a comment or email us.

0 Comments