It's a CONFIRMED scam company, recover your stolen funds by clicking the button below, then fill out the form and you will get a FREE Mychargeback consultation today:

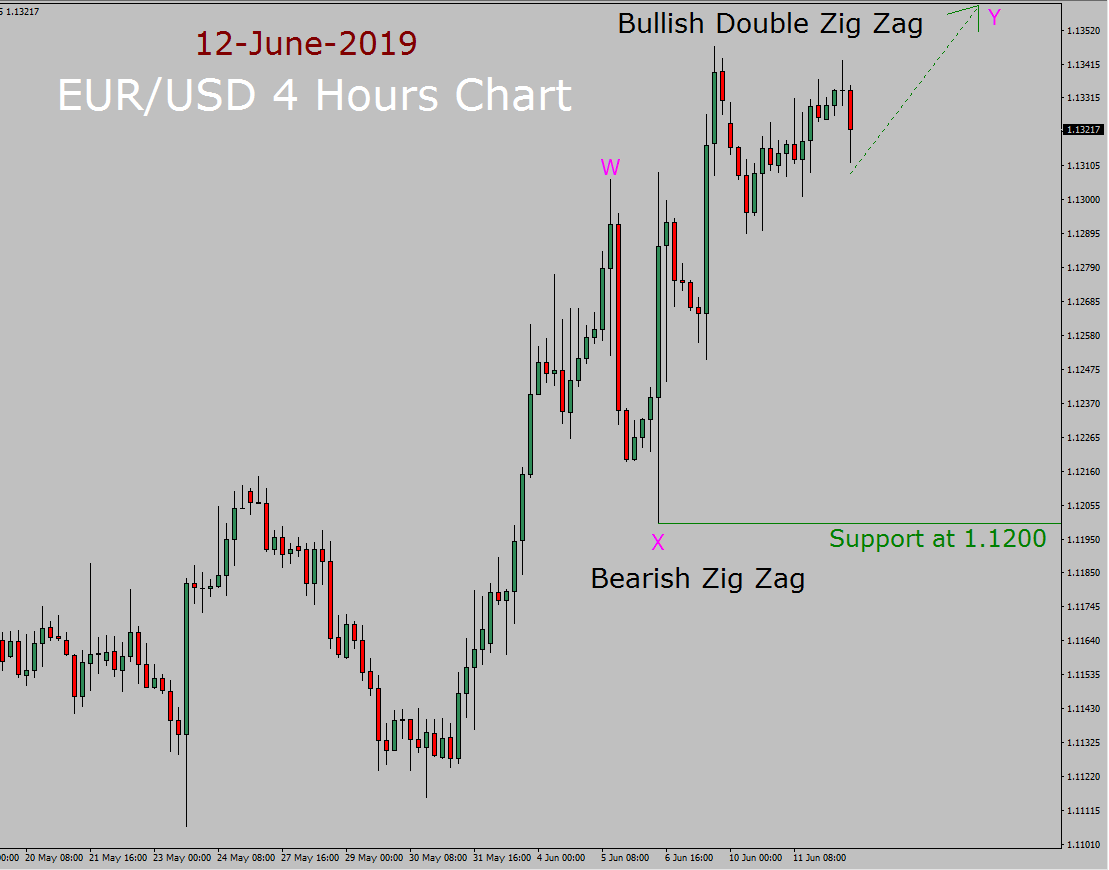

Based on technical analysis the bullish trend is present in EUR/USD currency pair, 4 hours time frame based on EUR/USD Elliott Wave Weekly Forecast. As I have forecasted few hours ago, the price of EUR/USD pair is going to rise up now to prints a Bullish Impulse Elliott wave pattern and traders should look for a buy trade. So, all those Forex traders who have followed my Elliott wave forecast have made the right decision as price has ascended.

Strong key support level is present at 1.1200 price area. In my judgment, price action in EUR/USD currency pair is now going to rise up more as the trend is bullish in 4 hours chart. So, market is going to remain bullish overall on a medium term basis. Based on Elliott wave forecast, the current Bullish trend is part of a Bearish Impulse Elliott Wave pattern, wave (C) leg which is going to complete corrective wave Zig Zag wave 2 leg in higher time frame.

Currently, Bullish corrective Elliott wave pattern wave Y looks in-complete. So, a good idea is to look for a possible buy trading chance to join an up trend around 1.1320 price area. However; if the price of EUR/USD currency pair breaks below 1.1200, vital support level then up trend is going to end. In such a market scenario, it would be best not to trade the Forex market and re-do the EUR/USD Elliott wave analysis in four hours chart.

If you are a trader who prefer to use robots and EAs to automate your trades and make them very profitable for you or require very good forex/stock training resources, please check this page.

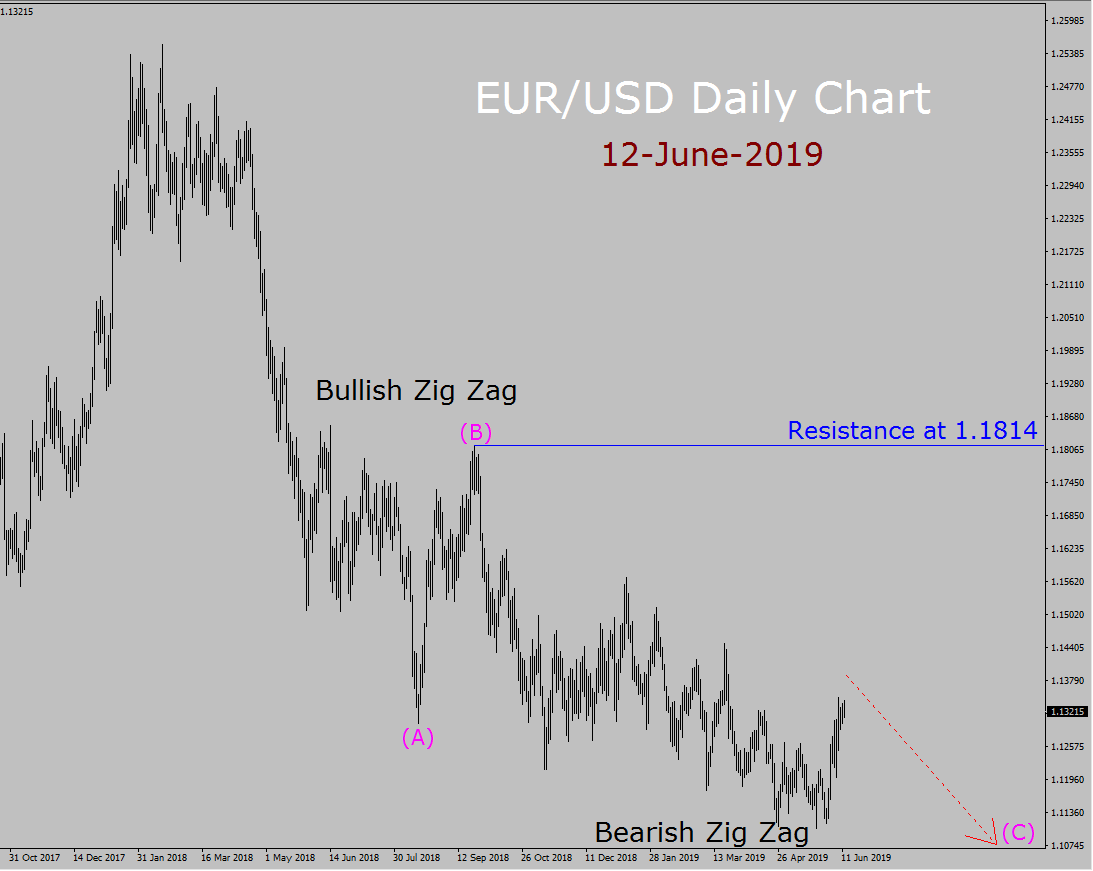

Now, at this point; I must acknowledge that the trend is also bearish in higher time frame of EUR/USD currency pair.

Below is the daily chart of EUR/USD pair with my Elliott wave forecast which shows us a big picture and a well started bearish trend as well.

Try SMARD today, it is a bot designed for crypto traders and investors which uses advanced algorithms to profit from market fluctuations. No programming or trading knowledge is required to start. The algorithm relies on momentum effect strategies to systematically identify market winners. Below are the key reasons why everyone loves Smard.club: 1. You get up to 5% average monthly return on your starting capital. 2. The 10% monthly service fee is charged from your profits only. They don't make money unless you do! 3. You can start with as little as $1000 in your exchange account, meaning that you just need to connect your existing exchange (or open a new one) with Smard and begin trading right away! 4. No upfront payments for the service. 5. It's a smart way of investing in your favourite crypto coins - btc/altcoins, hurdling them while at the same time growing their values through auto-trading instead of just buy and forget. Operating through API keys, SMARD ensures secure connections without requiring fund transfers to third parties. No upfront payment or card linking is needed. Try Smard today and see the real potential of your crypto portfolio, no upfront fees to pay!

To me; price has printed Bullish corrective wave (B) leg. Now, price action is falling down to complete the Bearish impulse wave (C) leg which is going to complete corrective Bearish Zig Zag pattern. So, now market is moving down on a medium term basis to complete the Bearish corrective wave (C) leg which is part of an overall corrective Bearish Zig Zag at wave 2 location. After that expects a bottom in price action as well. Wave (C) leg is the last and final decline and price is going to prints a long term bottom after that. Within the Bullish Zig Zag corrective Elliott wave pattern, all sub-waves must sub-divides into 5, 3 and 5 waves pattern.

The following Elliott Wave Bearish Zig Zag corrective pattern diagram shows us a completed Bearish Zig Zag pattern within the frame work of Elliott wave principle.

The bearish Zig Zag wave pattern of the Elliott wave principle shows that how price action does not moves in a straight line fashion but in a series of lows (retracements) and highs (rises). Bearish Zig Zag Elliott wave pattern in a down trending market could be seen inside the above image. The figure shows what a Bearish Zig Zag Elliott wave pattern looks like. If a trader knows what a bearish Zig Zag pattern looks like, then it would become much easy for a currency trader to actually analyze the Forex charts and make a trading decision as well.

A Bearish Zig Zag consists of two Impulse Elliott wave patterns, joined by a B wave. We use A English alphabet to label first impulse Zig Zag wave leg and we use C English alphabet to label second Impulse Zig Zag wave leg. Please take a note that Bearish Zig Zag pattern is a corrective Elliott wave pattern which appears at a pull back in a main down market trend.

Based on my EUR/USD technical analysis using Elliott Wave in daily chart, we have got an in-complete Bearish Zig Zag leg and price action is now falling down to prints bearish wave (C) leg. However; it is possible if price breaks above blue colour resistance line then forecast will become in-valid. Now, price action is probably going to move sideways and then drop lower to prints a Bearish impulse wave (C) leg. To me; in four hours chart of EUR/USD currency pair the bullish leg – Bullish Zig Zag corrective wave pattern wave ii which is part of a higher degree wave (C) in daily chart is just a bullish pull back in a down trend leg as mentioned above as wave ii Bullish Zig Zag corrective pattern inside a hours chart.

Strong key resistance level is present at 1.1814 price area in EUR/USD daily chart. So, I expect market to first move up for next coming trading days and then may be starts the decline. So, in my opinion market is going to remain bearish overall and on a medium to long term basis, expects a sideways leg in market. Next, market is probably going to resume the down trend after that in EUR/USD currency pair, in daily chart.

Now, when an existing Bearish Elliott Wave Weekly Forecast in EUR/USD is going to fail?

Well, the forecast is good for about next two weeks time and price should stays below 1.1814 resistance area in daily time frame to keep the down trend alive. A clear bullish break out in price action above 1.1814 resistance area will end the down trend and bearish Elliott Wave Weekly Forecast; in such a market scenario, it would be best not to trade the market and re-analyze EUR/USD daily chart.

Based on EUR/USD Elliott Wave Weekly Forecast the trend is down in daily chart and a good idea is to look for a sell trade around 1.1306 price area, as price action is going to drop more towards 1.1055 but a clear bullish break out in price action above 1.1814 vital resistance area will end the down trend. On a medium term basis, it is a bullish trend in EUR/USD 4 hours time frame and a good idea is to take a buy trade around 1.1320 price level and price is probably going to rise up towards 1.1360 price level. However; if the price of EUR/USD currency pair breaks below 1.1200 vital support level then bullish trend is going to end. We recommend trading with these top-rated brokers when using our signals/analyses/forecasts as they handle your trades quicker and more efficiently with very low spreads and most of them have high trade execution rate.

0 Comments