It's a CONFIRMED scam company, recover your stolen funds by clicking the button below, then fill out the form and you will get a FREE Mychargeback consultation today:

FinCapFx (fincapfx.com) claims to be one of the best platforms you can use to grow profits. Increase your Earning Potential is the tag that hits you when you land on their homepage. Unfortunately, nothing much Fin Cap FX offers that one can term groundbreaking. The platform is swindling funds from members by blocking withdrawals. Yes, no member has withdrawn for the past few weeks. Here’s what we found out in our credible FINCAPFX REVIEW.

In the about us section, FinCapFx claims to be a global brand. The company claims to have expanded its business all over the world. Yet, up until recently, we didn’t even know the platform existed. It’s the uproar that made us get concerned and dip deeper.

You can tell there’s no professionalism in how the platform handles the website. Navigating through it is quite a task as the platform tries to hide vital details. For example, you would think there are only three account types based on the homepage.

Other notable absentees include the contact widget or live chat tab, which is unavailable. One has to wonder how the platform expects to help members constantly. Today’s trader wants hands-on support 24/7.

The platform also has what they term a Risk Appetite Form. One would think that this is a viable document offered by the platform. Unfortunately, it couldn’t be further from the truth, and the platform knows no boundaries.

And that means putting your investment at risk. We suspect the platform could even sway investors into allowing them to invest on their behalf. And that’s why the form is available to fool naïve investors.

Try SMARD today, it is a bot designed for crypto traders and investors which uses advanced algorithms to profit from market fluctuations. No programming or trading knowledge is required to start. The algorithm relies on momentum effect strategies to systematically identify market winners. Below are the key reasons why everyone loves Smard.club: 1. You get up to 5% average monthly return on your starting capital. 2. The 10% monthly service fee is charged from your profits only. They don't make money unless you do! 3. You can start with as little as $1000 in your exchange account, meaning that you just need to connect your existing exchange (or open a new one) with Smard and begin trading right away! 4. No upfront payments for the service. 5. It's a smart way of investing in your favourite crypto coins - btc/altcoins, hurdling them while at the same time growing their values through auto-trading instead of just buy and forget. Operating through API keys, SMARD ensures secure connections without requiring fund transfers to third parties. No upfront payment or card linking is needed. Try Smard today and see the real potential of your crypto portfolio, no upfront fees to pay!

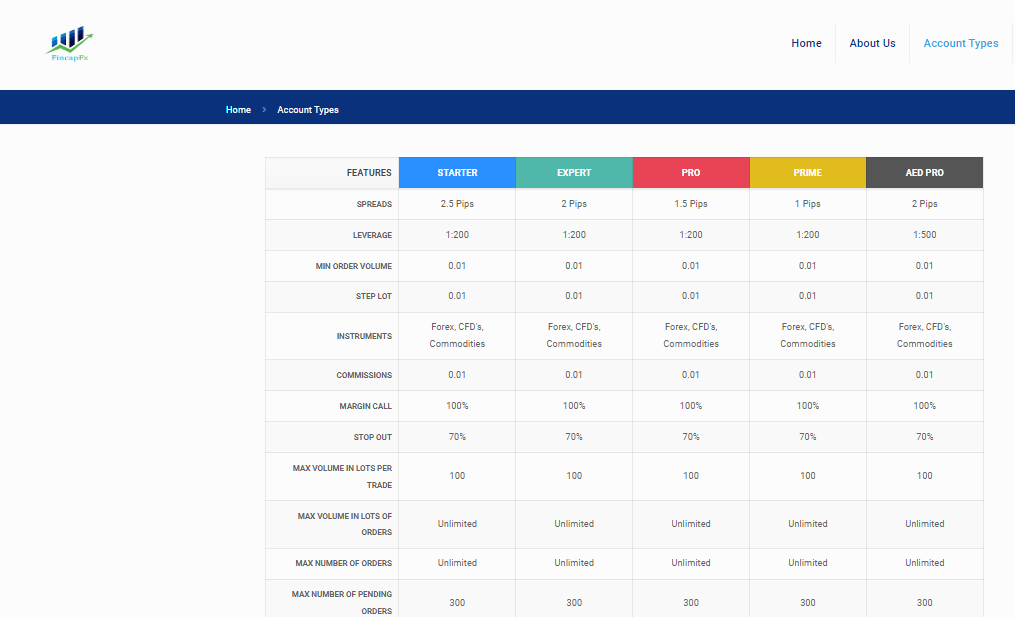

What can do see from the homepage is the assumption of getting low spreads from 0.1 pips. That’s not what you find under the account’s page. The account’s page indicates a minimum spread of 1 pip.

Before jumping and signing up with any trading platform, you must do due diligence. Try and find out what makes a platform tick. That’s the only way to invest and get a head start in a safe trading platform.

One of the first steps you must take when investing is reviewing the pros and cons. What makes investing with FinCapFx? Once you weigh the pros and cons, you can decide to move forward.

We know that the cons outweigh the pros regarding Fin Cap FX. Even some images on the about us page are stock images. There’s no effort in trying to create a unique platform for users.

Want to invest in Cryptocurrency? Why not!

Here’s what we found out as the cons of fincapfx.com

FinCap Fx furnishes members with an option of five trading accounts. These include Starter, Expert, Pro, Prime, and AED Pro. Each of these accounts has something different to offer. That’s why we will take a closer look at each account.

Starter

It’s the most basic account and best suited for beginners. You get an account with a leverage of 1:200 as spreads start from 2.5 pips. There are commissions of 0.01 on all accounts. Margin and stop out call are 100 and 70 percent, respectively.

Expert

You get the same leverage of 1:200 while spreads start from 2.0 pips. The maximum volume in lots per trade is 100, with an unlimited number of maximum orders. You get to trade three instruments, CFDs, Commodities, and Forex.

Pro

For the pro account holder, leverage is also the same, 1:200. Spreads start from 1.5 pips with a step lot of 0.1. The maximum number of pending orders on all accounts is 300. There’s no mention of minimum acceptable leverage.

Prime

You get leverage of 1:200 with spreads starting from 1.0 pip. So the only difference between this account and the other three is the spreads. And that makes it weird as it doesn’t offer many different features.

AED Pro

It’s the most exclusive account with members enjoying maximum leverage of 1:500. Spreads start from 2 pips. That’s just about it regarding the account features of these five plans.

There’s no mention of an available minimum deposit. We suspect that this is where the con game all starts. First, the platform will call you and request you deposit as much as possible. Then, you get a claim that the more you deposit, the higher your chances of winning.

Another issue we have with the platform is regarding acceptable leverage. Industry regulators accept maximum leverage of 1:100 on all CFDs, commodities, and Forex. The platform blatantly goes over the limit.

There’s also no option of a demo account. The platform expects users to sign up without the option of testing these features blindly. And that’s not a favorable option to have as a user. That’s why we must expose these account flaws.

Opening an account with FinCapFx is a straightforward process. All you need is to fill in the required fields. Our main issue with the platform is when it comes to authenticating the user or validating them.

The platform will require you to send valuable documents for proof. These include a copy of your ID, bank statements, and credit card information. We don’t see the reason for this. The platform can use a two-factor authentication process.

No, your funds are far from safe with a platform with no valid trading license. That means the platform doesn’t deposit the required amount with regulators to start a trading entity. The deposit is insurance cover to protect the public from unforeseen losses.

That means you won’t enjoy any protection from regulators. Once the platform blocks withdrawals or shuts down, you won’t get compensation. The platform also lacks DDoS protection or SSL encryption.

Who owns or runs the platform remains a mystery. And that’s why we have to expose the platform for anonymity. You should avoid anonymous platforms as you don’t know who handles funds.

The owner could be laughing all the way to the bank with every deposit you make. That’s one of the reasons why platforms need to be clear on who works for them. Likewise, you need to know who to hold responsible when things turn south.

FinCapFx is not a licensed or regulated trading platform. No regulator has issued a license or permit to the platform. And that makes investing with an unregulated platform a high-risk venture.

Check with regulators and confirm whether the platform is dully registered. Some notable regulators include ASIC, BaFIN, CFTC, CNMV, CONSOB, and CySEC. Others include FCA, NFA, and the SEC.

Don’t expect any contact or support from the platform. That means you won’t get any much-needed help from staff. And that means the platform leaves members to fend for themselves or solve issues.

There’s no need to deposit with a platform that will later block withdrawals. No member has made any withdrawals for the past five weeks.

After reviewing the platform, we recommend you stay away from fincapfx.com.

Note: The best traders are those who invest in suitable options. Take Cryptocurrency investing as one of those credible ways of investing.

Feel free to drop a comment or email us with any queries.

0 Comments